The Crafts Council has launched the first Market for Craft report to identify the global appetite for British craft measured over the past decade, revealing that our passion for handcrafted products has never been greater. Craft sales have increased from £883 million in 2006 to £3 billion in 2019.

Prior to the Covid-19 pandemic Crafts Council worked with eight national partners to survey 5,000 UK residents, 1,500 American citizens, 1,700 professional makers. This was merged with a further Crafts Council survey of 573 UK-based makers carried out during lockdown. Partners include: Arts Council of Wales, Contemporary Visual Arts Network, Craft Northern Ireland, Craft Scotland, Creative Scotland, Creative United, The Goldsmiths Company, Great Northern Contemporary Craft Fair/ Great Northern Events.

The rise of self-employment in the UK, facilitated by online platforms, is greatly contributing to the growth of crafting. Research for the 2020 study showed that 35% of the makers surveyed earn a living solely through their work. 22% supplement their income by teaching craft workshops or courses, and a further 18% do so with other freelance work connected to craft. Over one fifth of all makers (21%) supplement their income via non‑craft related employment.

The proportion of disabled makers has more than doubled since the 2006 study, with around a quarter of makers in 2020 having a disability.

Almost three-quarters of British adults (73 per cent) bought craft in 2019, amounting to some 25 million handmade items. Almost a third of those consumers (32 per cent) are under the age of 35, making this the single largest demographic of craft connoisseurs. As craft has entered the mainstream, the market has become dominated by more cautious, cost-conscious buyers. This needs to be recognised in the strategies adopted to promote craft and in the marketing approaches of makers.

More egalitarian market conditions and fewer barriers to entry for makers mean that whilst more people are now buying craft, they are buying craft at a lower value. This means that the challenges faced by master craftspeople and established makers at the higher end of the sector remain similar to those identified in 2006 – they still need to differentiate their skill to justify their higher prices. The average price per object has decreased from £157 in 2006 to £124 in 2020.

Wider trends affecting the British craft market include the rise of e-commerce, a consumer desire to support small businesses and buy products that are more sustainable, choosing authentic products and investment pieces of sound provenance over throwaway objects. Around 10.3 million Brits are buying their crafts online, a number which has trebled over the past decade, although the majority would still rather buy something in store.

Makers – especially new and emerging makers – were keen to see help for buyers to identify objects of recognised quality, collectability and originality, underpinned by a campaign to educate and inform them about craft. Two-thirds of makers felt that an easily accessible, centralised, signposted searchable database would help with sales, with extended search functions including visual tags, to identify objects based on colour or pattern or style without needing to know a maker’s name. Built-in algorithms replicating the “Customers who viewed this item also viewed” approach of online retailers would expose potential buyers to a wider range of makers beyond those they are already familiar with and buying from.

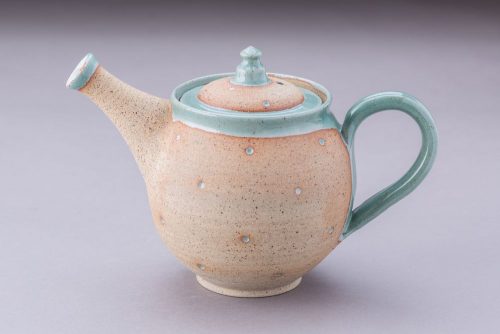

Jewellery is the most popular craft discipline to purchase by volume, but glass and metal have seen the most sizeable growth since 2006.

The report also showed that there is great export potential for British crafts, finding that 2.5 million people in New York and 1.7 million in Los Angeles have bought from UK-based maker, spending an average of around £210. A further 6.9 million across these two cities said they would likely buy from a British crafter in future. A British look or aesthetic was the most commonly cited reason for buying UK craft.

Covid-19 has further stimulated the growing trend for crafts, as the BBC’s Great British Sewing Bee shifts to a prime-time slot with audiences of around 5 million. Sellers of craft supplies are also seeing a surge in demand, with 20 per cent of British consumers saying they would consider paying to attend a craft workshop. Online tutorials and craft kits have understandably grown in popularity during lockdown.

Executive director of the Crafts Council, Rosy Greenlees says: “The report provides valuable evidence to understand more about how best to stimulate, support and grow the craft market: who’s buying craft, what they’re buying and why, how big the market is, how routes to market are changing, and what kind of infrastructure can best support it. Our first step will be translating the findings into actionable learnings for the craft sector, helping them build a richer picture of different consumers and their habits and interests in order to help grow sales.

“While the growth in the market is encouraging, the picture is not all positive. A quarter of makers are facing a negative impact from Brexit on their business, and many makers will be in a precarious situation in a post-pandemic world, losing not only their opportunities to sell their work, but also other sources of income, for example, teaching and hosting workshops.”